TOPICS & NEWS

Articles and interviews on current trends, technology and industry challenges, information on our consulting services, seminars and events as well as company topics:

Here you can find out what drives EFESO.

Breaking the Mold as a Factor for Success

Threat or opportunity? How established automotive industry suppliers can hold their own in the switch to e-mobility

Is the switch to e-mobility following in the footsteps of previous technological automobile innovations? If so, expect combustion-engined vehicles to be outnumbered by their hybrid and electric peers on our roads before long. The example of ESP (electronic stability program) perfectly illustrates the “establishment phases” of new technologies that are first rolled out in premium vehicles for wealthy and techsavvy customers and then deployed across all model classes when the technology is tried and tested. Rolled out in the Mercedes S-Class Coupé in 1995, ESP is now a standard fixture in all new cars in Europe, but has failed to dominate in many places. By comparison, initial signs of this development have already emerged in e-mobility. The Tesla Model S, for example, was not only the best-selling premium-class automobile in the USA in the third quarter of 2016, its sales even outperformed the second- and third placed Mercedes S-Class and BMW 7-series combined! However, in the case of e-mobility, new competitors from the Chinese automotive industry may prove the real “moldbreakers”, given an increasing focus on e-mobility, and look set to make their market presence felt.

In any case, as a car nation, Germany will be one of the first to notice what a switch to e-mobility will entail, because Germany itself is a key producer of automobiles as well as being one of the pioneer markets, where new models and vehicle concepts achieve large market shares from an early stage.

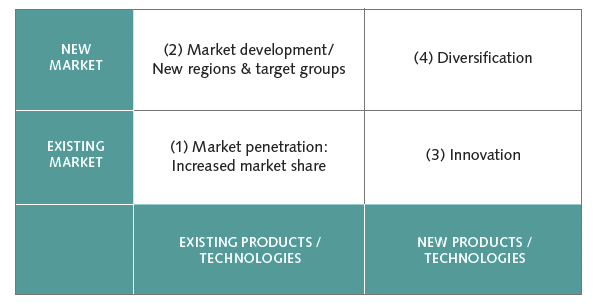

The consequences of e-mobility on the automotive industry here and the associated service sector will therefore be very far-reaching (see diagram on p. 7). Virtually every company that supplies components and systems for the traditional powertrain faces a serious threat, given that their market in Germany is shrinking and will disappear in the foreseeable future. For these companies, e-mobility becomes an existential question, which can only be met with new strategies. The chances of survival can be shown in very simplified form using a product-market matrix (also known as an Ansoff matrix):

Affected companies should now decide on which quadrants they wish to focus their activities. This spawns specific strategies and different areas of focus:

(1) Market penetration/(2) Market development:

If a company decides to continue working with its existing products and technologies, it should focus its activities on sales/marketing and production footprint. A sensible production footprint (which products are produced in which locations) coupled with a high OEE (overall equipment effectiveness) is the prerequisite for ensuring competitive production costs. Traditional lean manufacturing tools provide important assistance to continuously optimize OEE. However, the chances of increasing your own market share or even opening up new markets tend to be limited, because the market for all automotive manufacturers and suppliers is usually saturated. Gaining ground here means to be better than the competitors, who can also produce good products favorably. Moreover, this approach depends on the combustion engine retaining an appreciable share of overall global car production. Until then the company wins time and money, in order to prepare the bigger step into one of the other two quadrants.

(3) innovation/(4) diversification:

If a company instead sets itself the goal of working with new products or technologies, its focus should be on managing innovation and developing products. The crucial question concerning the available expertise in the company should be considered in the case of innovation management – because this is what paves the way for product development. It is also important to take into account whether demand for an existing product will be sustained if the product has to be revised. Air-conditioning units and parking heaters, for example, will continue to exist, even if the drive or energy source is different. In contrast, eliminating the combustion engine will also end demand for components like spark plugs or oil filters.

Product development and diversification may open up greater growth opportunities, but may also bring greater risk. The company must invest significantly and may have to work with new, unfamiliar markets. The success factor here is clearly speed. New ways of finding ideas have to be created which are strongly customer- oriented perspective. Furthermore, new business models have to be revealed. In addition, the potentials of products and services must be considered. The example Car Sharing shows how OEMs are currently changing into service providers. To master innovations and new technologies quickly, for example through a lean PEP (product development process), is becoming increasingly important. Who could imagine some years ago, that Google is able to produce a own car so quickly? Therefore, cooperations with companies that complement the lack of competencies and build strengths are gaining in importance. And ultimately, it's tremendously important to convince and inspire one's own team to take new paths to innovation quickly and openly.

In this sense the pattern break becomes the success factor. In addition, it is more than ever important to gain speed - whether by devoloping completely new approaches, a clear strategy and the courage to "cut off old braids". New market players such as Tesla, Google and Co. do not have these strains. Whether companies perceive electromobility as a threat or take it as an opportunity depends entirely on them.