FROM “BUILD” TO “BOOST”

NORTH AMERICAS

How U.S. companies are coping with labor shortagesand a human resources gap

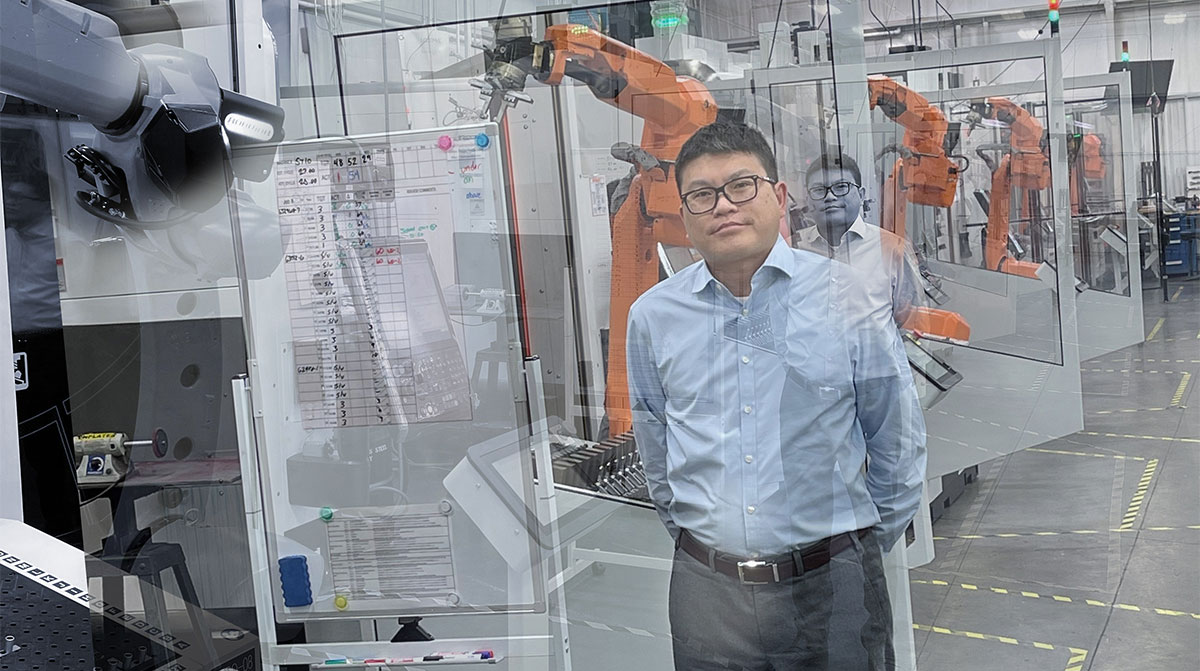

By Konto Chan, Vice President

The EFESO office in New York City “crosses” three countries: USA, Mexico and Canada. The US is our major market that we want to grow for sure, in line with the great dynamism and demand for consulting in many business fields. In terms of challenges and opportunities, let’s take a look at four focus topics.

#1: Operational excellence

In terms of operational excellence, the pandemic pushed many value chains in the manufacturing industry to their breaking point in 2020. COVID-19 caused interrupted production and in turn depleted the safety stock inventory in the supply chains, especially in our food and beverages client base. As lives slowly returned to normalcy in 2021, manufacturing companies struggled to keep up with the surge in demand coupled with a bullwhip effect. To make the matter worse, a workforce transformation (career shift, early retirement) has been triggered by the pandemic which resulted in a significant labor shortage. The result is an unprecedented capacity deficit in the US.

To help our existing and new clients with this situation, we are taking advantage of ROI-EFESO’s newly developed Boost approach. In the past decades, our approach was more that we Built OPEX capabilities with the client, then the results would come. Now we are converting our consulting model much faster from “Built” to “Boost”.

With the Boost approach we get very intensive to drive results, and then build capability of the client later. Approx. more than two thirds of our request of projects is about driving volume, releasing capacity, improving productivity. EFESO North America’s business saw a recovery in 2021 and had a very strong 4th quarter in particular. Due to labor shortage, we get unconventional requests for interim management positions in addition to driving improvement on capacity. The client needs are changing, we are quickly converting to that type of support to meet those needs. And instead of engaging a consultant for four or five days a month, one (or more) consultants are now on site with clients full-time for months.

More than two thirds of our request of projects is about

driving volume, releasing capacity, improving productivity.

#2: Digitalization

Digitalization is already an integral part in the corporate strategies across all industry boundaries in the US. But similar as in other countries, many companies are struggling to move forward. They have a lot of existing and discrete digital systems (ERP, MES, PLC, etc.) in place. These challenges are multiplied by M&A. For example, in the food & beverages industry a lot of companies have gone through many acquisitions. Over the time, they have a different set of IT infrastructures and an inherent complexity of legacy systems. These companies are left with two options, to replace existing systems with a common one, or to find an appropriate platform to integrate all existing systems. Both options prove to be challenging and difficult to justify the cost associated.

#3: Sustainability

More or less, sustainability is like a marketing slogan for some US brands. But there is a huge gap between marketing and acting – which is mainly due to the costs associated with sustainability programs. For example, while product packaging is closely related to sustainability, the corporate perspective is mainly that of cost reduction. The performance indicator ends up being how much material cost can be saved in packaging, and not how much longterm benefits could be made to the environment through innovation.

From the consumer’s point of view, in terms of the need for sustainability or the desire for sustainable products, the US seems to lack behind some other developed countries, unfortunately. If they were really serious about sustainability, companies would focus more on innovation and look closer at their supply chain framework. Hopefully, there will be a consumer-driven change – but as long as consumers do not demand it, or the government does not impose regulations when it comes to sustainability aspects, it is not a priority for enterprises to expand their sustainability beyond costs. There isn’t any major legislation at the moment, e.g. that plastic has to be reduced in the food and beverage industry.

When it comes tosustainability, there is

a huge gap betweenmarketing and acting.

#4: Human dynamics

As already mentioned, there is an ongoing labor shortage in the US, and it is worsening. Companies are competing to hire new people and these people need to be trained. However, education and training are put on the back burner, as the focus is on expanding production. So, this is the spiral where we want to produce more with unskilled people, we generate a lot of quality problems. Competition in hiring drives up labor cost and the accelerated inflation makes matter worse.

All this affects the bottom line of the company. So, most industries are in a very difficult transition situation. Manufacturing companies try to solve that by speeding up automation. However, if you accelerate automation, you face another challenge, because a company cannot be fully automated and still needs people. The challenge then becomes how employees can adopt to the new technology and transformation fast enough.

EFESO clients: our consulting focus in North America

- One out of every two of our clients is in food and beverages. Post COVID, there is an unprecedented capacity deficit, and our clients are focused on increasing production volume by improving productivity and efficiency in an accelerated way.

- Sustainability is not a main factor in food and beverage projects – different from some other countries, there is not a strong push from the consumers or the legislation to drive innovation for sustainability beyond cost reduction.