(Kopie 1)

“Today's import barriers will prevent tomorrow’s exports”

Recommended action for new global market scenarios

Interview with Dr. Johannes Fritz, research fellow of the Max Schmidheiny Foundation at the Swiss Institute for International Economics and Applied Economic Research at the University of St. Gallen and project manager for the Global Trade Alert published there

DIALOG: Dr. Fritz, every year you record the quantity and nature of the protectionist measures used by G20 states to combat foreign economic interests on behalf of the Global Trade Alert. How protectionist is Germany in international comparison?

DR. JOHANNES FRITZ: Germany is mid-table – and likewise the other large EU member states. For me, that reflects the success of European integration. On the one hand, classical trade barriers such as import duties are now defined at a European level. Centralization hinders efforts by individual member states to close their borders quickly and systematically. Conversely, the Commission scrutinizes compliance within the European single market closely and thus ensures that members can undertake very little against 60-75 percent of their imports. What we are seeing more and more in Germany and Europe are not classical trade restrictions, but rather export subsidies or state aid targets for companies engaged in the real economy as a result of the financial crisis.

DIALOG: Protectionism has long since established itself in many leading economic nations as the method of choice for protecting their own trade interests. TTIP and CETA have also shown that those in Europe, too, are far from free trade fans. What dangers does this development bring for companies in the DACH region [Germany, Austria, and Switzerland]? Do you also see any opportunities?

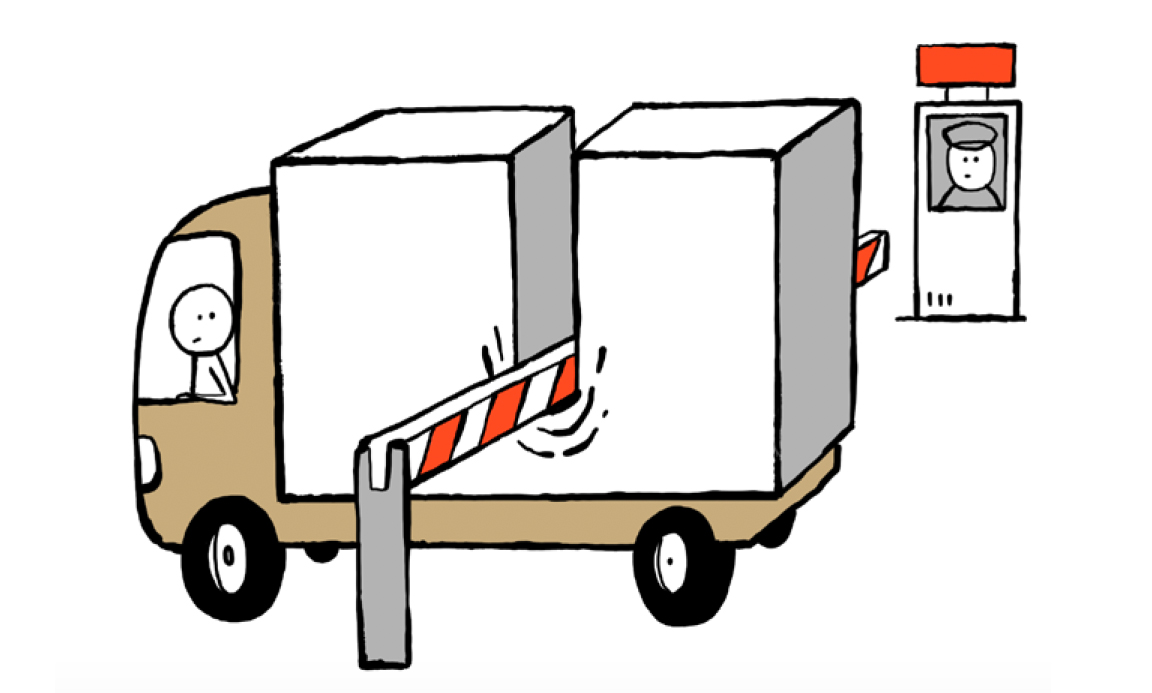

JF: The danger is that any short-term success will outshine long-term consequences. Free trade is effective through its compound interest and closely resembles technological progress in a way. It is something that you can block out relatively painlessly for a while, but you risk being left completely behind. What these discussions frequently overlook is that the strongest exporting industries are generally those that are most import-dependent. “Today's import barriers will prevent tomorrow’s exports”. I think that companies in the DACH region benefit in such uncertain times from a large – and in trading terms, stable – European economic region, despite all its problems.

DIALOG: What measures should German manufacturing companies adopt in response to developments in the USA and Mexico if they have built up production sites and supplier networks over the years? What special recommendations would you give to supply companies that have followed their customers to these countries with production sites?

JF: Keep calm, as little will change at the USA/Mexico border. In my view, it is more likely that the new US government will direct assistance to domestic industry and will not erect major trade barriers to Mexico. A very market-friendly Republican Party will not follow the administration into a trade war with neighboring states. President Trump is primarily interested in jobs, and not imports as such. He is more likely to focus on tax breaks for manufacturing, or modify the public procurement process to safeguard American jobs. Apart from this, immigration policy is a likely target for this trend.

DIALOG: China is leveraging both open and concealed protective measures for domestic companies to assert its interests. What developments can the German economy expect here in the next few years?

JF: It is very difficult to predict in the short term. The boundary between China’s private economy and its public sector is very porous. State and quasi-state businesses are active instruments in China's industrial policy. Monetary flows are very often difficult to identify. Moreover, China’s economic policy is implemented in a very decentralized manner. Trade-related decisions are delegated right down to the city level. In the medium term, it will be interesting to see how serious the Chinese government is about promoting regional economic integration. The Chinese have launched their own Asian free trade zone, RCEP, not least in response to the TPP free trade zone negotiated under American leadership. The intention is to conclude the negotiations this year. Manufacturers and suppliers in the DACH region will then face similar questions about location as with the North American Free Trade Area.

About Global Trade Alerts

The Global Trade Alert of the University of St. Gallen provides realtime information about government measures that were adopted during the global downturn and which may influence foreign trade. Unlike other monitoring initiatives, Global Trade Alert also identifies trading partners likely to be harmed by such measures. You can find more information at www.globaltradealert.org