THE TRANSFORMATION TURBO

THOSE WHO HAVE A NOTARIALLY CERTIFIED LAND REGISTER ENTRY IN THE WEST CAN SLEEP PEACEFULLY.

For the end of the world must already be at hand in order to call into question the validity of such a paper.

Things are different in many countries around the world. Because there, supported by corrupt authorities, large landowners and corporations can ensure comprehensive expropriations. In case of doubt, an entry in the land register has never existed – or the expropriator has always been in it. Blockchain technology could radically change these centuries-old conditions within a short time. The information recorded in a distributed ledger – a digital, decentralized account book – cannot be deleted or manipulated. And even the most corrupt official and the most brazen landlord could not change that.

SOMETIME THEY’LL BUILD A BANK AND NOBODY WILL COME

The potential of the blockchain to change established patterns in one fell swoop is, of course, dramatic in the industry and in our daily lives. A few facts may help to understand this. By using the blockchain, the infrastructure costs in banking can be reduced by 30 percent. The global market volume of this tenyear-old technology could grow to over 20 billion dollars in just five years. IBM is investing about a quarter of a billion dollars in blockchain-based IoT solutions – and is working with Wal-Mart, for example, to use blockchain to track the origin of food and organize product recalls. In just two seconds, Wal-Mart can determine where bad food comes from. An analogous application for the control of retrofits and recalls in the automotive industry is obvious. But the outlook is particularly striking in the financial sector: suddenly a complex global financial system can be imagined without central and commercial banks, without insurers, PayPal and credit card companies. You have children? Just don’t let them do an apprenticeship as a bank clerk ...

DISRUPT THE DISRUPTOR

However, the storm is not only affecting the banks by far. The Israeli software boutique La`Zooz, for example, is attacking Uber & Co head-on with its juicy fees by building a blockchain-based, decentralized community platform. And the German start-up Slock.it uses the blockchain to develop a global, decentralized platform for intelligent locks. Almost incidentally, Slock.it talks about being able to fully automate the Airbnb apartments with its solution. Which raises the question of the viability of the Airbnb business model. Thanks to Blockchain, two of the world’s largest Unicorns could go under the wheels even before they have completed their own disruption work and collected their wages through a successful IPO.

THE TRANSFORMATION TURBO

CRYPTO CURRENCIES ARE ONLY ONE FACET OF THE BLOCKCHAIN

So much dynamism makes you dizzy - and skeptical. Yet today hardly anyone doubts that the blockchain will be a powerful lever for profoundly changing systems and processes, making countless business models obsolete and making new ones possible. In particular, the fact that a blockchain replaces professional trust brokers and ideally systematically excludes any manipulation of - not only financial - transactions and any concealment lets the fantasies flourish. Virtual currencies such as Bitcoin, Ethereum or Ripple, whose value is no longer guaranteed by a central bank, are only one facet of this automated trust: their fungibility and quantity are limited, their use is problematic in many respects. This is why it is more important to focus on where real weights are being moved – in the financial and industrial transaction processes.

TECHNOLOGY FOR THE IOT AGE

And this is where it gets interesting because the blockchain promises maximum protection in a highly networked, automated and digitized world. Processes and business models based on the Internet of Things are often based on a large number of very small transactions and payment transactions. These can only be designed economically if, on the one hand, they are highly automated and, on the other hand, guarantee a high level of safety - at minimum cost. Blockchain technology is ideally suited for this - through de facto non-corruptible sophisticated cryptography, the distribution of copies of the “account book” over all participants connected to the blockchain, the inalterability of the documented transactions. Even the smallest process step and the least important property of the objects recorded on the blockchain is unchangeably and indelibly documented, financial transactions are lean, inexpensive and fast to implement.

AGE OF ENLIGHTENMENT

But, obviously it is not as simple as the information graphics of the advertising brochures. Only one in eight IT managers today has a clear idea of how their company could use the blockchain, as a recent IDG survey shows. Blockchain technology is a bit like teenage sex, says Vincent Doumeizel, VP at global auditing specialist Lloyd’s Register: “Everybody is talking about it, not many are doing it, and those that are, are doing it badly”. It seems that the blockchain is much harder to penetrate than other disruptive technologies such as AI, 3D printing, or robotics. The technological “growth pains” - such as the low speed, the high energy consumption, or the protocol confusion currently still prevailing - are not the decisive reason for this. Rather, it is the fact that blockchain-based processes are very different from ideas that have shaped our systems and process networks for decades.

THE MOST IMPORTANT SCENARIOS FOR THE SUPPLY CHAIN

TRACEABILITY OF PRODUCTS, PROCESSES AND INFORMATION

The more complex our products and processes become and the higher the share of software in them, the more we depend on absolutely forgery-proof and uninterrupted documentation. The low depth and global distribution of value creation require trust mechanisms that today can only be realized with enormous effort - if at all. This problem is compounded by the increasing skepticism with which both end customers, auditing bodies and government authorities are looking at the economy. Here the blockchain can help to create lasting trust and to enable a secure, purely fact-based and in a positive sense amoral business basis. On a technical level, a standardized API can be used to ensure that the sending and reading of information follows a defined process. In this way, all partners involved in the value-added process can be easily integrated and the supervisory authorities can be granted clearly defined data access - without the mountain of printed and digital documents that exists today.

ASSET TRACKING

Similar to the traceability example, asset tracking in the supply chain can also be reorganized using blockchain technology. For example, machines and systems can be connected directly to the blockchain. In this way, machine conditions can be recorded precisely and without human intervention, version statuses in the manufacturing process and product properties can be documented completely and in real time. At the same time, the software used in the production process can be effectively monitored and managed by Smart Contracts. All accesses are securely and completely recorded in a distributed ledger. Blockchain technology thus also provides central building blocks for the implementation of the Smart Factory concept - especially with regard to security, efficiency and autonomy.

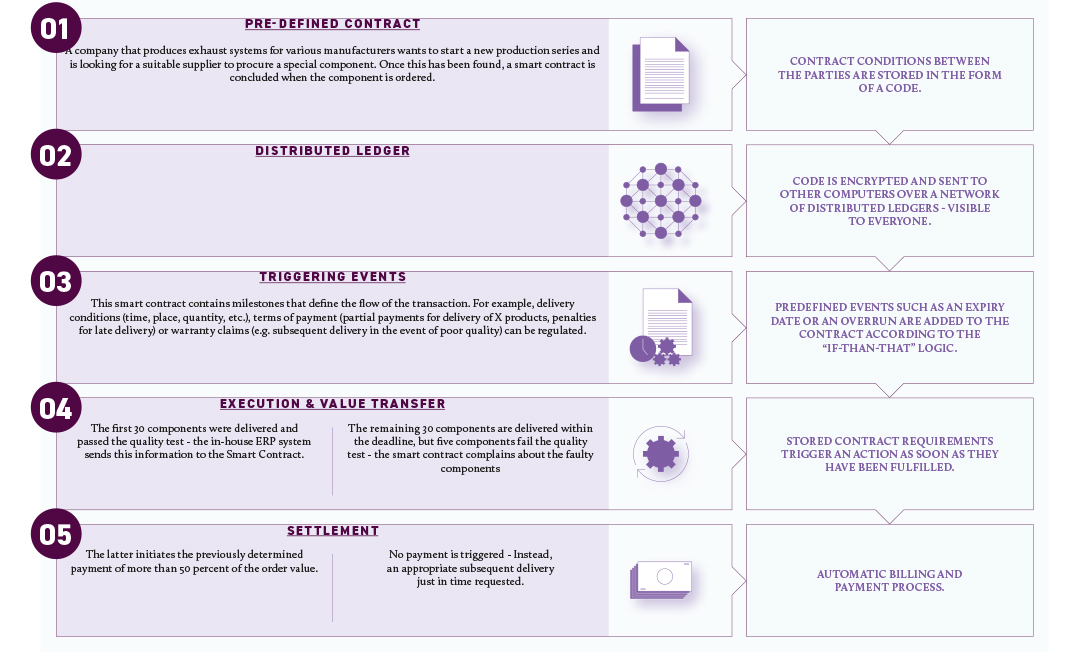

SMART CONTRACTS

Perhaps the most promising application of the blockchain are Smart Contracts - software scripts that ultimately run automated if-then routines and allow actions to run automatically and not manipulable when certain parameters are received. The Smart Contract concept, already more than twenty years old, is gaining enormous importance with the security standards and documentation options of the blockchain. In the context of the supply chain, smart contracts - which control production events, routine transfers of ownership, payment transactions, or shipping notifications - can trigger a surge in rationalization and automation. In particular, the so-called “Ricardian Smart Contracts” can contain all contract and order-relevant data and thus ensure a high degree of procedural and legal transparency and security. Although many legal aspects of smart contracts have not yet been finally clarified, it can be assumed that national and international legislators will provide a clear legal basis in the coming years.

PROTECTION OF INTELLECTUAL CAPITAL AND MANAGEMENT OF PROPERTY RIGHTS

The more partners involved in product development worldwide, the more complex and confusing the legal situation and the determination of property rights become. This applies to both physical products and digital Smart Products & Services, whose origin and genesis are harder to determine and prove. The use of new technologies, such as 3D printing, also increases the IP risks when products are produced worldwide according to predefined digital sketches. Smart contracts can clearly regulate not only the financial transaction and product specifications, but also the IP and ensure clear manufacturer identification. Digital fingerprints of virtual and physical products can be securely stored in the blockchain and access to this data, including changes and versions, can be clearly documented.

BEYOND THE HYPE

On Gartner’s famous hype curve, the blockchain is currently at a critical point - namely almost exactly at the dividing line between the “peak of inflationary expectations” and the “valley of disillusionment”. This transition is known to be associated with an implosion of expectations – and an incipient, intensive reality test. According to Gartner, it will take the blockchain five to ten years to develop a broad impact as a productive technology. Of course, even the blockchain will not turn the world upside down overnight and put established business models in a corner. And some will never reach the end of the valley – or are still on the road after ten years. But betting on this outcome is perhaps better left to the landlords of Latin America.